![]()

Please have your social security number, date of birth, and policy or certificate number available. The BIS will review your policy's benefit eligibility criteria with you and assist you in starting your claim. If a claim is opened, an Initial Claim Packet (ICP) will be sent to you via fax, email, or mail for you to complete and sign.

This form authorizes MetLife to obtain copies of your medical records. *Please note that if your physician's office or treatment facility requires a separate authorization form, please submit both forms with this packet*

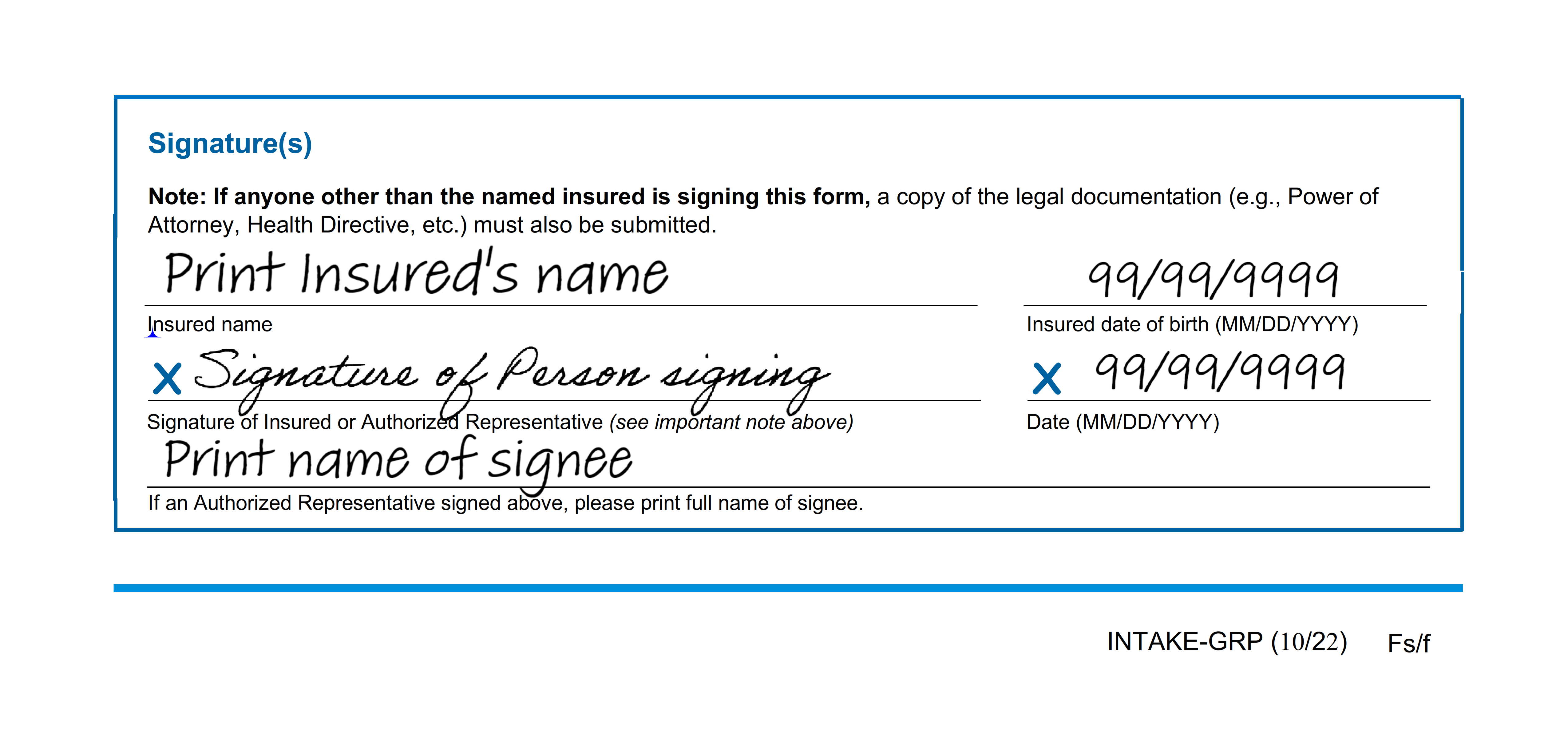

Who can sign the Medical Authorization form?

For this form to be valid it must be signed by the Insured, or the primary legal medical representative. If the primary legal medical representatives are co-agents who must act jointly, BOTH agents need to sign the Medical Authorization form.

A copy of the Medical legal document must be included.

Who is a Legal Medical Representative?

A Legal Medical Representative includes a Medical Power of Attorney (POA), Health Care Proxy/Advanced Health Care Directive, Court-Appointed Guardian, or the Executor of Estate.

*Please note if the Insured is deceased, the Executor of the Estate will need to sign the Initial Claim Packet. Additionally, a copy of the Last Will and Testament and/or Executor paperwork will need to be provided.

Example of the Long-Term Care Medical Authorization Form

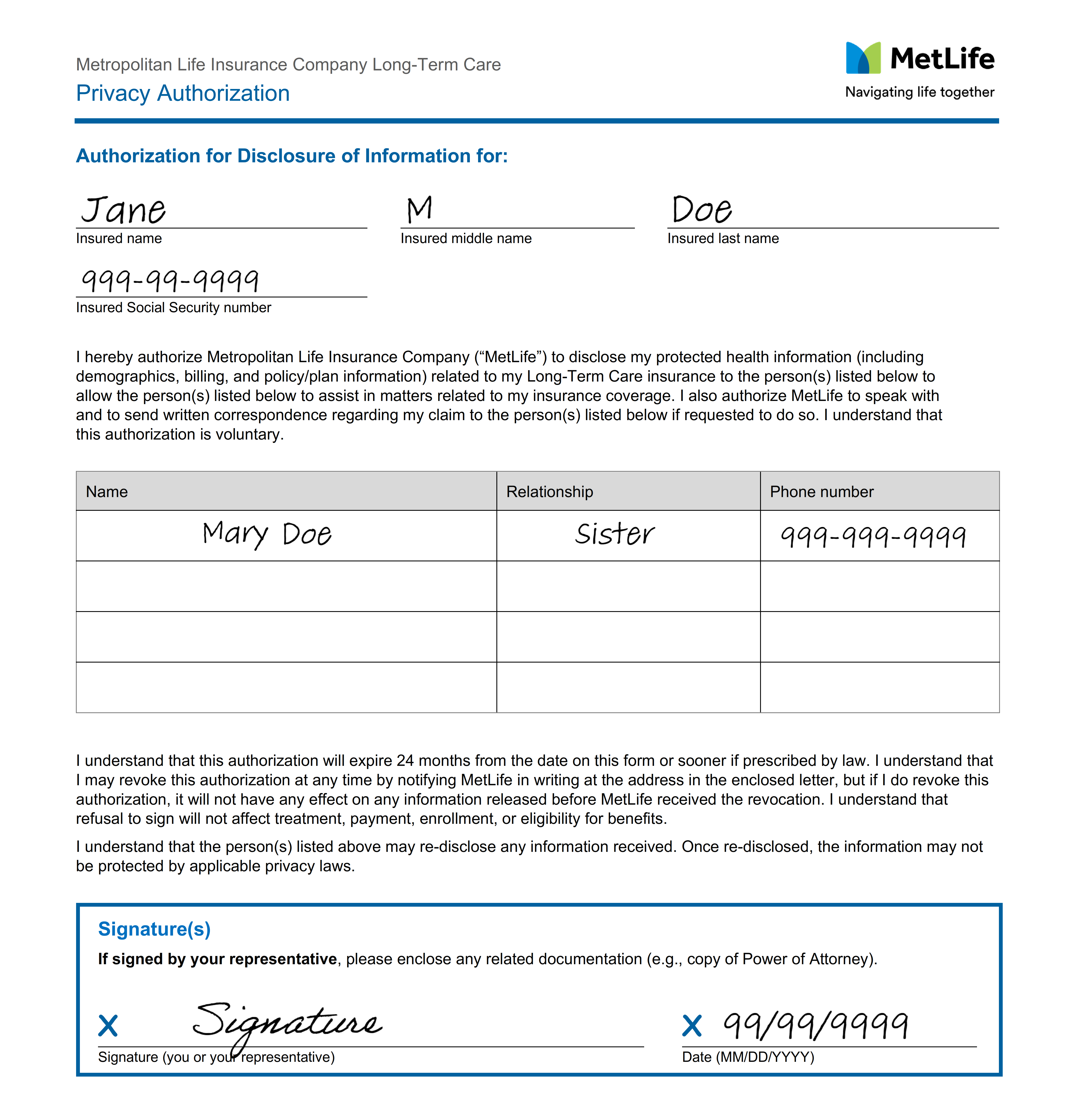

This form authorizes MetLife to release personal health information and policy details about your Long-Term Care claim to another person(s), such as family members or friends.

Who signs the Privacy Authorization form?

For this form to be valid it must be signed by the Insured, Spouse, or a primary legal financial representative. If the primary legal financial representatives are co-agents who must act jointly, BOTH agents need to sign the Privacy Authorization form.

Who is a Legal Financial Representative?

A Legal Financial Representative includes a Durable or Financial Power of Attorney, Court-Appointed Guardian, a Living Trust/Will, or Executor of Estate.

Do I need to add Medical Providers on this form?

The Insured does not need to list LTC providers or physicians on this form, we do not use this form to obtain medical records.

Example of the Privacy Authorization Form

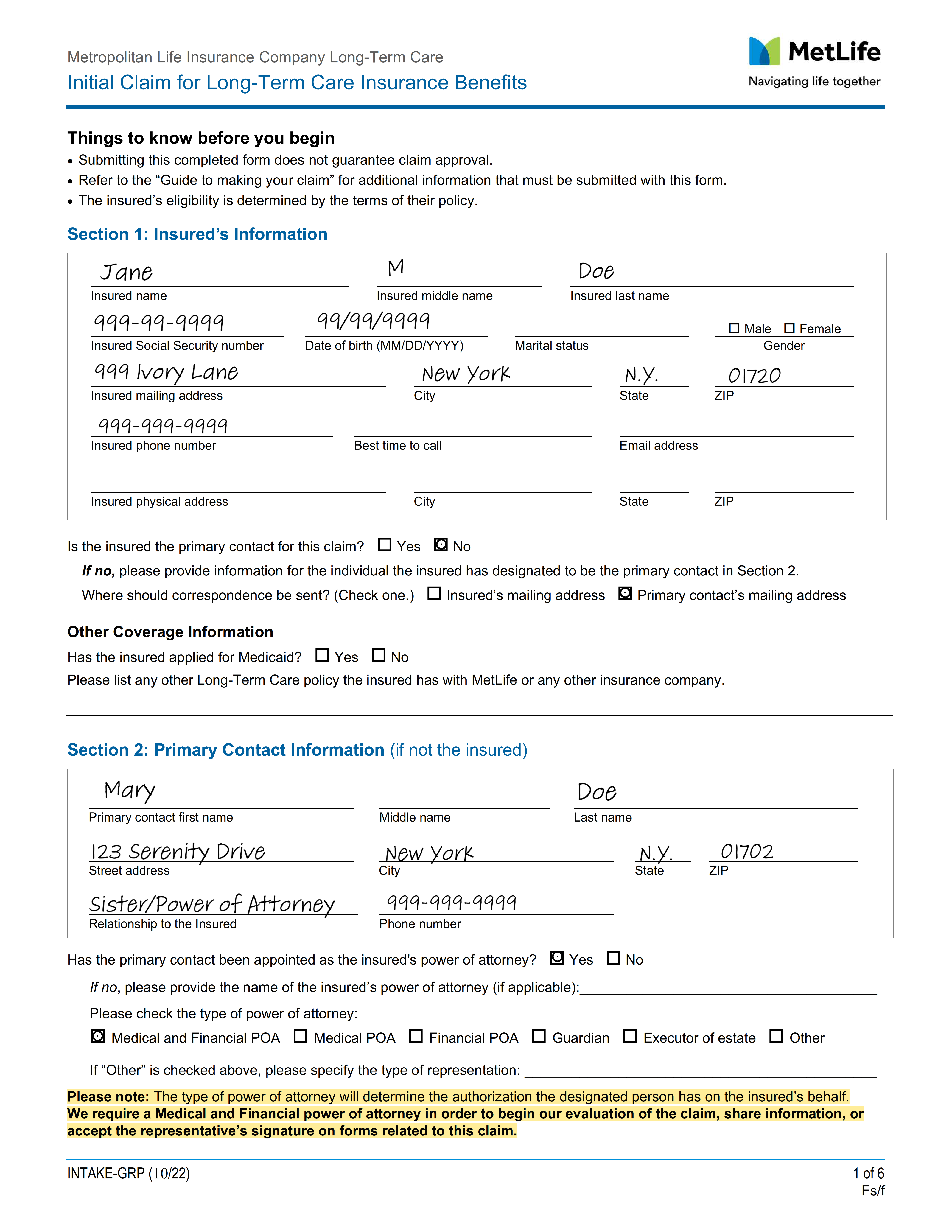

Section 1 details the Insured’s current information such as name, date of birth, phone number and current address.

Section 2 details who the Primary Contact will be for the claim.

Who can update the Insured’s address on file?

The Insured’s address can be updated by the Insured, Spouse, or primary Financial representative.

Who can be listed as the Primary Contact for the claim?

Anyone may be the primary contact for the claim. However, if the primary contact is NOT the Insured’s medical or financial representative, they MUST be listed on the Privacy Authorization form.

Example of Section 1 and 2

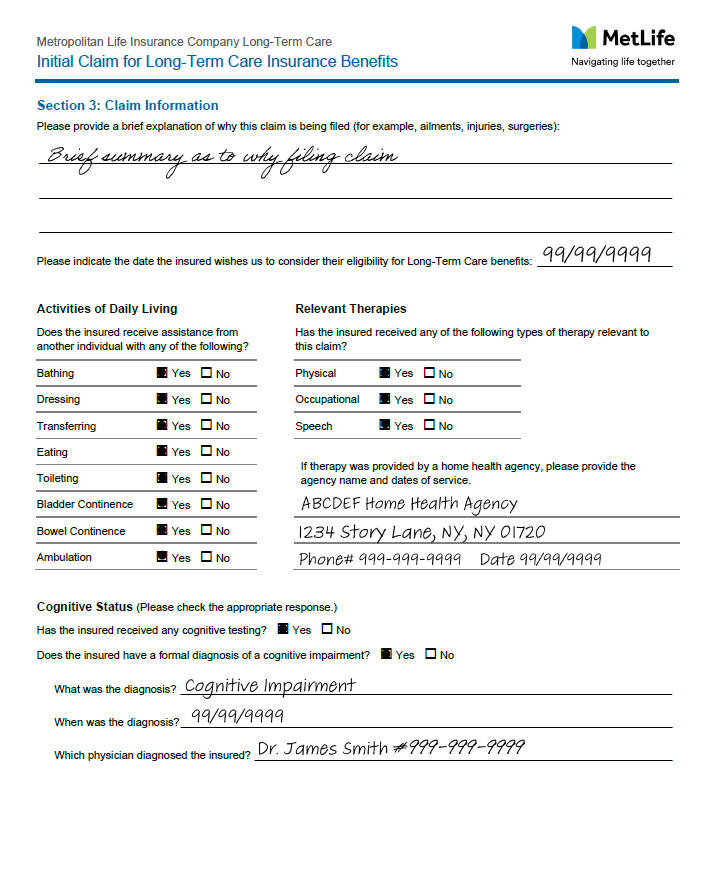

Section 3 and 4 details the Insured’s current condition, reason for filing the Long-Term Care claim, and relevant medical providers regarding the Insured’s condition.

What is a brief explanation of why the claim is being filed?

Please provide 2-3 sentences detailing the Insured’s need for assistance with Activities of Daily Living, supervision due to a Cognitive Impairment, or current ailments, injuries, and surgeries.

What doctors need to be listed on the Initial Claim Packet?

Doctors with medical records relevant to the Insured’s current condition should be included in section 4.

Example of Section 3 and 4

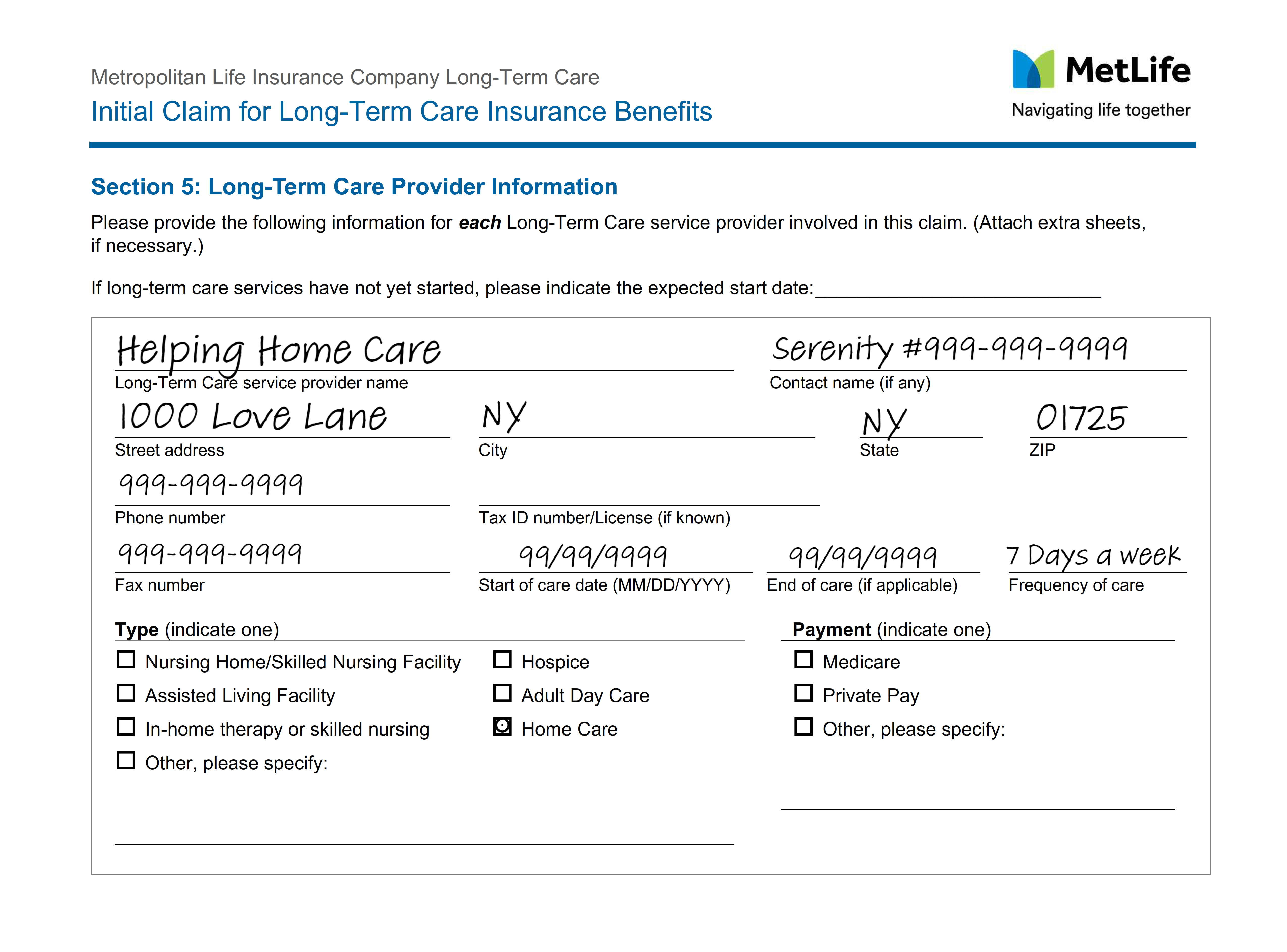

Section 5 details pertinent information regarding the Insured’s Long-Term Care Providers

What is a Long-Term Care Provider?

A Long-Term Care Provider can be a Nursing Home, Assisted Living facility, Home Care, Adult Day Care, Informal Caregiver or Independent Licensed Caregiver depending on the Insured’s policy.

Please be sure to list the providers name, address, phone number and start/end dates of care so we may obtain the relevant medical records.

Example of Section 5

Both areas Section 6a/6b need to be completed by the Insured, Spouse, or the Legal Financial Representative.

Who is a Legal Financial Representative?

A Legal Financial Representative includes a Durable or Financial Power of Attorney, Court-Appointed Guardian, a Living Trust/Will, or Executor of Estate.

If the legal documents are not submitted, it may cause delays. Please note if the Insured is deceased, the Executor of the Estate should sign the Initial Claim Packet and we will need a copy of the Last Will and Testament and/or Executor paperwork.

Once all necessary documentation is received, your claim will be assigned to a Care Coordinator for the eligibility review.

Example of Section 6A/6B