Health insurance and tax

The best health insurance for you will depend on your budget and personal circumstances. Our experts have chosen a bunch of picks that will be great for a lot of folks, but these should only be used as a guide. You should always read the PDS to know if a product is a good fit for you.

The top picks were updated by our team of insurance experts after 80+ hours of research across 45+ health funds. They were reviewed by insurance publisher Tim Bennett in August 2024.

Basic Hospital Plus Elevate $750/$1500 Excess

Hospital onlyOne of the only good value basic hospital policies on the market. Many basic policies don't cover any hospital treatments. HBF Basic Elevate covers 18. Bonus points – it lets you avoid the Medicare levy surcharge (MLS) (the tax you need to pay if you earn over $97,000 as a single). The not-for-profit also won Finder's 2024 best health fund of the year award.

Pros

Cons

It won the 2024 Finder Awards for best basic hospital policy for the second year in a row. These awards compared all eligible basic hospital policies on the market. It won based on value for money, covering more treatments in a private hospital for a lower premium than any other fund. While basic hospital cover allows you to avoid paying the MLS if you earn over $97,000 a year as a single or $194,000 as a couple, it's often terrible value for money – many don't cover any hospital treatments at all. HBF's Basic Plus Elevate actually gives you some cover in return for your money. Additionally, 92.5% of hospital services have no out-of-pocket costs, according to the latest ombudsman report. That's more than all 23 other open membership insurers, including the 4 major funds, Bupa, HCF, Medibank and nib. Average prices are updated monthly when we update Finder's database of health insurance policies. Prices are based on a single individual with less than $97,000 income, $750 excess and living in Sydney.

Blood

Bone joint and muscle

Cancer

Dental surgery

Digestive system

Ear nose and throat

Gastrointestinal endoscopy

Gynaecology

Hernia and appendix

Joint reconstructions

Kidney and bladder

Male reproductive system

Miscarriage and termination of pregnancy

Skin

Tonsils adenoids and grommets

ahm health insurance

ahm won the 2023 Finder Customer Satisfaction award. Out of the 750+ customers surveyed, it scored highly for customer service, value for money and application process. It also has some of the cheapest hospital policies on the market.

Pros

Cons

We asked 765 Australian customers for their opinion about their health fund. ahm scored highly for ease of application and customer service. 86% of people said they would recommend it to a friend. No fund did better than this. In total, there were 8 eligible health funds included in Finder's 2023 Customer Satisfaction Awards, including Bupa, Medibank, Australian Unity and HCF. We've also used complaints data from the Ombudsman's State of the Health Funds Report. *Prices are based on a single individual with less than $97,000 income, $750 excess and living in Sydney.

HCF HOSPITAL BRONZE PLUS $750 EXCESS

Hospital onlyThis won the Finder Award for best value bronze policy for the second year in a row. It scored higher than all 100+ bronze plans we assessed. It covers 25 hospital treatments – 7 more than a standard bronze policy. The not-for-profit also has a really strong record of giving its money back towards members.

Pros

Cons

HCF was the winner of our bronze category at the 2024 Finder Awards. It covered more treatments for less money than any other fund. Average prices are updated monthly when we update Finder's database of health insurance policies. Prices are based on a single individual with less than $97,000 income, $750 excess and living in Sydney.

Blood

Bone joint and muscle

Brain and nervous system

Breast surgery

Cancer

Dental surgery

Diabetes management

Digestive system

Ear nose and throat

Eye excluding cataracts

Gastrointestinal endoscopy

Gynaecology

Hernia and appendix

Joint reconstructions

Kidney and bladder

Lung and chest

Male reproductive system

Miscarriage and termination of pregnancy

Pain management

Palliative care

Medically necessary plastic surgery

Podiatric surgery

Skin

Sleep studies

Tonsils adenoids and grommets

Medibank Gold Protect + Growing Family 70

Hospital and ExtrasThis comes with lots of benefits you don't get with other insurers. In addition to pregnancy cover, continuity of care and IVF cover, you get access to its 24/7 Medibank Nurse service, an OptimalMe program for mums-to-be and a pregnancy health concierge. The Growing Family Extras cover includes antenatal and postnatal classes.

Pros

Cons

Medibank offers a lot of pregnancy-related benefits that you won't get with other insurers, including 24/7 Medibank Nurse service, an OptimalMe program for mums-to-be and a pregnancy health concierge. Additionally, the extras portion of the policy goes further than others we researched including ahm, Bupa, St.Lukes and HBF. Medibank is also above average for percentage of extras charges covered (52.60% vs 49% overall) according to the latest ombudsman report. Average prices are updated monthly when we update Finder's database of health insurance policies. Prices are based on a single individual with less than $97,000 income, $750 excess and living in Sydney.

Assisted reproductive services

Back neck and spine

Blood

Bone joint and muscle

Brain and nervous system

Breast surgery

Cataracts

Cancer

Dental surgery

Diabetes management

Dialysis for chronic kidney failure

Digestive system

Ear nose and throat

Eye excluding cataracts

Gastrointestinal endoscopy

Gynaecology

Heart and vascular system

Hernia and appendix

Hospital psychiatric services

Implantation of hearing devices

Insulin pumps

Joint reconstructions

Joint replacements

Kidney and bladder

Lung and chest

Male reproductive system

Miscarriage and termination of pregnancy

Pain management

Pain management with device

Palliative care

Medically necessary plastic surgery

Podiatric surgery

Pregnancy and birth

Rehabilitation

Skin

Sleep studies

Tonsils adenoids and grommets

Weight loss surgery

General Dental

Major Dental

Endodontic

Orthodontic

Optical

Non-PBS Pharmaceuticals

Physiotherapy

Chiropractic

Podiatry

Psychology

Acupuncture

Remedial Massage

Glucose monitor

Qantas' silver hospital policy was highly commended in the 2024 Finder health insurance awards because it offered some of the best value coverage among other silver hospital policies. Qantas is also offering new customers up to 120,000 Qantas Points over 6 months when you join an eligible combined policy by 13 September – the more comprehensive your cover, the more points you'll earn. T&Cs apply. You also get 1 Qantas point per $1 spent on premiums.

Pros

Cons

Bronze Plus Simple Hospital $750 Excess + Top Extras

Hospital and ExtrasThis combined hospital and extras policy could be good for complete families. Bupa's Top Extras policy covers orthodontics, dental check-ups are free with certain dentists and there's no excess for kids. You're also exempt from paying the Medicare levy surcharge if you earn over $194,000 a year as a family.

Pros

Cons

Every family has slightly different health needs, so you should always do your own research and make sure the policy covers the treatments you and your family want. We selected Bupa because it has several benefits for families. It has one of the largest hospital networks in Australia, no excess for kids, $0 dental check-ups for the family at Member First Platinum dentists, orthodontics are included with its Top Extras and your children can stay on the policy until 31. Plus, 91.1% of Bupa's medical services have no gap. This is the 7th best out of all open membership health funds. There are 23 in total. Its Bronze Plus Simple Hospital option is also one of the cheapest bronze policies on the market. Out of 118 policies, it was the 4th cheapest, $1 more than ahm. Average prices are updated monthly when we update Finder's database of health insurance policies. Prices are based on a single individual with less than $97,000 income, $750 excess and living in Sydney.

Blood

Bone joint and muscle

Brain and nervous system

Breast surgery

Cancer

Dental surgery

Diabetes management

Digestive system

Ear nose and throat

Eye excluding cataracts

Gastrointestinal endoscopy

Gynaecology

Hernia and appendix

Joint reconstructions

Kidney and bladder

Lung and chest

Male reproductive system

Miscarriage and termination of pregnancy

Pain management

Podiatric surgery

Skin

Sleep studies

Tonsils adenoids and grommets

General Dental

Major Dental

Endodontic

Orthodontic

Optical

Non-PBS Pharmaceuticals

Physiotherapy

Chiropractic

Podiatry

Psychology

Acupuncture

Remedial Massage

Hearing aids

Glucose monitor

Silver Hospital $750/$1500 Excess

Hospital onlyHBF won a lot at this year's Finder Awards, including health fund of the year and best value silver policy. HBF Silver covers 30 treatments (4 more than a standard silver policy) and is cheaper than its competitors. Government data also shows it has the best track record for no gap, hospital charges covered and benefits.

Pros

Cons

It won the 2024 Finder Awards for best silver hospital policy. These awards compared all eligible basic hospital policies on the market. It won based on value for money, covering more treatments in a private hospital for a lower premium than any other fund. Plus, 92.5% of HBF's hospital services have no out-of-pocket costs, according to the latest ombudsman report. That's the best out of all open membership insurers. Average prices are updated monthly when we update Finder's database of health insurance policies. Prices are based on a single individual with less than $97,000 income, $750 excess and living in Sydney.

Back neck and spine

Blood

Bone joint and muscle

Brain and nervous system

Breast surgery

Cancer

Dental surgery

Diabetes management

Digestive system

Ear nose and throat

Eye excluding cataracts

Gastrointestinal endoscopy

Gynaecology

Heart and vascular system

Hernia and appendix

Implantation of hearing devices

Insulin pumps

Joint reconstructions

Kidney and bladder

Lung and chest

Male reproductive system

Miscarriage and termination of pregnancy

Pain management

Pain management with device

Palliative care

Medically necessary plastic surgery

Podiatric surgery

Skin

Sleep studies

Tonsils adenoids and grommets

Medibank Gold Protect + Top Extras 60

Hospital and ExtrasThis product is well-priced for what it covers. There are cheaper policies but they don't include as many treatments. For example, you could pay around $68 per week and be covered for 10 extras treatments or, with Medibank, you could pay around $75 per week (just $7 more) and be covered for 14 treatments.

Pros

Cons

We picked this product for seniors because it includes thorough, comprehensive cover. Additionally, we picked it because it covers more than other combined gold and extras policies, yet remains competitively priced.

Assisted reproductive services

Back neck and spine

Blood

Bone joint and muscle

Brain and nervous system

Breast surgery

Cataracts

Cancer

Dental surgery

Diabetes management

Dialysis for chronic kidney failure

Digestive system

Ear nose and throat

Eye excluding cataracts

Gastrointestinal endoscopy

Gynaecology

Heart and vascular system

Hernia and appendix

Hospital psychiatric services

Implantation of hearing devices

Insulin pumps

Joint reconstructions

Joint replacements

Kidney and bladder

Lung and chest

Male reproductive system

Miscarriage and termination of pregnancy

Pain management

Pain management with device

Palliative care

Medically necessary plastic surgery

Podiatric surgery

Pregnancy and birth

Rehabilitation

Skin

Sleep studies

Tonsils adenoids and grommets

Weight loss surgery

General Dental

Major Dental

Endodontic

Orthodontic

Optical

Non-PBS Pharmaceuticals

Physiotherapy

Chiropractic

Podiatry

Psychology

Acupuncture

Remedial Massage

Hearing aids

Glucose monitor

advanced hospital gold + Lifestyle Extras

Hospital and ExtrasThis product is particularly good for mental health as the extras portion of this policy does not have a waiting period to access psychology and counselling services — it's the only provider to do this.

Pros

Cons

We picked this product because it offers comprehensive coverage when looking specifically at mental health benefits. While there are other policies with higher cover limits, ahm's extras policy waives the waiting periods and we believe that timely access to these benefits can be helpful to those needing access to mental health services.

Assisted reproductive services

Back neck and spine

Blood

Bone joint and muscle

Brain and nervous system

Breast surgery

Cataracts

Cancer

Dental surgery

Diabetes management

Dialysis for chronic kidney failure

Digestive system

Ear nose and throat

Eye excluding cataracts

Gastrointestinal endoscopy

Gynaecology

Heart and vascular system

Hernia and appendix

Hospital psychiatric services

Implantation of hearing devices

Insulin pumps

Joint reconstructions

Joint replacements

Kidney and bladder

Lung and chest

Male reproductive system

Miscarriage and termination of pregnancy

Pain management

Pain management with device

Palliative care

Medically necessary plastic surgery

Podiatric surgery

Pregnancy and birth

Rehabilitation

Skin

Sleep studies

Tonsils adenoids and grommets

Weight loss surgery

General Dental

Major Dental

Endodontic

Orthodontic

Optical

Non-PBS Pharmaceuticals

Physiotherapy

Chiropractic

Psychology

Acupuncture

Remedial Massage

Basic Hospital Plus Elevate $500/$1000 Excess

Hospital onlyHBF's basic hospital plus elevate health insurance policy is great for under 30s who are looking for a basic policy to avoid paying the Medicare Levy Surcharge (MLS). It's relatively cheap yet covers a few more treatments than other basic policies. If you're young, healthy and looking for a tax-purposes policy, this could be worth looking at.

Pros

Cons

We picked this policy because it won the 2024 Finder Award for Basic Hospital. It won because it's a good value for money policy that lets you avoid the MLS, which is typically a motivator behind under 30s getting a health insurance policy.

Blood

Bone joint and muscle

Cancer

Dental surgery

Digestive system

Ear nose and throat

Gastrointestinal endoscopy

Gynaecology

Hernia and appendix

Joint reconstructions

Kidney and bladder

Male reproductive system

Miscarriage and termination of pregnancy

Skin

Tonsils adenoids and grommets

HBF Flex 50 won Finder's Medium Extras cover award in both 2023 and 2024. This is because it gives you $800 to split across a bunch of benefits, including dental. You can either split the $800 or use it entirely on dental.

Pros

Cons

We picked HBF's Flex 50 extras only policy for dental because its high coverage limit means you can get up to $800 back on dental treatments. It is also the 2023 and 2024 award winner because it covered more treatments for less money than its competitors.

General Dental

Major Dental

Endodontic

Optical

Non-PBS Pharmaceuticals

Physiotherapy

Chiropractic

Psychology

Acupuncture

Remedial Massage

Bronze Plus Hospital 750

Hospital onlyIf you want more for your money, AIA could be a good health insurer for you. You get access to AIA Vitality, money off gym memberships, cashback on Virgin flights, money off gift cards and more. The Bronze Plus policy is particularly good value. It costs around $24 per week, $3 more than the cheapest bronze option, and covers 23 hospital services (5 more than is required for a bronze policy).

Pros

Cons

We picked AIA Health Insurance because it gives you access to AIA Vitality with all of its policies. Our insurance experts feel AIA is worth calling out because you can't get access to the same quality of health benefits with any other fund. However, everyone's needs are different so it's worth doing some research yourself. With GMHBA you can only get access to AIA Vitality with some policies. We selected the Bronze Plus option because it only costs marginally more than the cheapest bronze policies available and it covers 5 more treatments than a standard bronze hospital policy. AIA also received a lower percentage of complaints compared to GMHBA. You can also get AIA Vitality with CommBank. However, you need to be a CommBank customer, so we excluded it from eligibility. Average prices are updated monthly when we update Finder's database of health insurance policies. Prices are based on a single individual with less than $97,000 income, $750 excess and living in Sydney.

Blood

Bone joint and muscle

Brain and nervous system

Breast surgery

Cancer

Dental surgery

Diabetes management

Digestive system

Ear nose and throat

Eye excluding cataracts

Gastrointestinal endoscopy

Gynaecology

Hernia and appendix

Joint reconstructions

Kidney and bladder

Lung and chest

Male reproductive system

Miscarriage and termination of pregnancy

Pain management

Medically necessary plastic surgery

Podiatric surgery

Skin

Tonsils adenoids and grommets

If you're looking for the best health insurance in Australia, it's basically impossible to get a single answer. Hospital vs extras, price, how much you're covered for, benefit limits, waiting periods and more – there's a lot to consider. The 11 policies above are a starting point.

Our sources include the 2024 Finder Health Insurance Awards, the ombudsman and APRA, plus customer reviews from the Finder Customer Satisfaction Awards.

Our product data comes directly from the government. You can actually download this data yourself, if that floats your boat. Unless you're a programmer though, it's not going to be very useful – not to mention incredibly boring – so we got our engineers to turn the data into something you can actually understand. The Ombudsman also releases the State of the Health Funds report every year. It includes reams of information about complaints, out of pocket expenses, extras services covered and more. We use it to determine our picks. APRA, the Australian Prudential Regulation Authority, releases quarterly statistics about the private health insurance industry, too. They help us to understand what kind of cover Australians are most likely to take out, so we're able to tailor our picks towards stuff you actually want and use.

We run the Health Insurance Customer Satisfaction Awards every year to find out what Australia's favourite health funds are. This year, we asked over 750 customers to rate their insurer based on features, customer service, value for money, ease of application, customer service and whether they would recommend it to a friend.

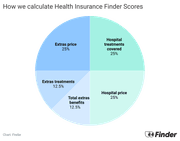

While it's hard to label any single company as the 'best', there are a few things to keep an eye out for that can help you understand each insurer's strengths. We've used data from the government's latest State of the Health Funds report to break down the top 5 for benefits paid, hospital-related charges covered and no-gap medical services.

We only looked at open membership funds – these are ones available to all Australians. If you're entitled to join a restricted membership fund though, it's worth considering. They sometimes perform better than open funds.

This is the percentage of total contributions the insurer received that it returned to contributors in benefits.

The is the proportion of private hospital charges covered on average.

This is the the proportion of medical services for which a gap is not payable by the patient.

These are the hospital insurance policies that came out on top in the 2024 Finder Awards. Each award category is based on the government's hospital tiers for gold, silver, bronze and basic policies.

Below are the results of the Finder 2023 health insurance Customer Satisfaction awards. These tell us which health funds Aussies think is the greatest for customer services and overall experience. We got responses from over 750 Australians to get these results. Funds without a score didn't get enough reviews for us to be confident of the results.

| Brand | Overall satisfaction | Customers who'd recommend |

|---|---|---|

| ★★★★★ 4.17/5 | 86% | |

| ★★★★★ 4.10/5 | 84% | |

| ★★★★★ 4.09/5 | 79% | |

| ★★★★★ 4.09/5 | 79% | |

| ★★★★★ 4.07/5 | 84% | |

| ★★★★★ 3.99/5 | 81% | |

| ★★★★★ 3.96/5 | 83% | |

| ★★★★★ 3.67/5 | 66% |

"If you think you might need an elective procedure such as a knee replacement or cataract operation in the next few years, health insurance is worthwhile as public hospital waiting lists can be very long."

Professor Luke Connelly Professor of health economics, University of QueenslandPro tip: Basic hospital policies let you avoid the MLS but they're often poor value. Basic plus or bronze policies give you more value for money.

Private health cover is a type of insurance available in Australia as an alternative to Medicare, which is Australia's public health care system. Even though all Australian citizens and permanent residents are eligible for Medicare, private health insurance will cover you for care in the private hospital system. This has a few benefits, including shorter waiting times for surgery, a private room, and the ability to choose your own surgeon in many cases. Private health insurance comes in 2 flavours in Australia, extras cover and hospital cover.

Not everyone needs private health insurance, but it has a lot of benefits that might make sense to you. If you're eligible for Medicare, then you'll always have access to emergency and medically necessary treatment for free in a public hospital. However, private health insurance gives you access to benefits including your choice of doctor, your own room, better amenities and shorter wait times for elective surgery. There's also extras and ambulance cover to think about, which can be worth it even if you're young and healthy. Find out if private health insurance might be worth it for you with this 1-minute quiz.

Medicare is Australia's public healthcare system, which entitles citizens and permanent residents access to life-saving care for free in a public hospital. Unfortunately, Medicare isn't perfect! for hospital care, there can be long waiting periods for elective surgery, you probably won't get to choose your own doctor, and you may have to share a hospital room. With private hospital cover, you can get these benefits in a private hospital. Additionally, Medicare doesn't cover many out of hospital services, such as dental, optical and ambulance. Private health insurance has options to cover these as well. Learn more about Medicare vs private health insurance.

The best hospital cover is the one that suits your needs and circumstances, so it may be different for everyone. However, HCF won the 2024 Finder Health Insurance Award for best fund and performed well in the government's State of the Funds report, so is a good place to start.

The best health insurance fund depends on what you're looking for. For some, that could be a not-for-profit and for others it could be the most popular health insurer. It might help you to know that HBF was awarded Finder's Best Health Fund award for 2024.

Since every family has different health needs, the easiest way to find a policy is to compare family options using our health insurance engine. For example, depending on your circumstances, you may want to get pregnancy cover if you plan to have kids or look for a policy that covers your teenager for free.

Many visitors and temporary workers aren't eligible for the same health insurance policies as Australians. Instead, you'll need overseas visitor health cover (OVHC). This is a type of health insurance designed specifically for non-Australian residents. These policies start from around $64.50 a month and at the very least should cover hospital care and repatriation. Some can also help pay for doctor's appointments, prescription medicine and out-of-hospital treatment such as dental.

There are lots of ways to get cheaper health insurance including paying annually, joining a restricted fund if you're eligible and mixing and matching your hospital and extras cover because it often costs less to get a policy with 2 different funds.

No gap in Australian health insurance means you won't pay any extra fees on top of your regular premiums for specific services. Your insurer covers the full cost beyond what Medicare pays for things like surgery or certain treatments. Just remember, it only applies to specific services and policies can vary, so always check the details with your provider to avoid any surprises.

Medibank Gold Protect + Growing Family 70 is a great option for those looking for pregnancy cover in their health insurance. It's good because it comes with benefits you don't get with other insurers, such as 24/7 access to Medibank Nurse - an OptimalMe program for mums-to-be and pregnancy health concierge. It also includes antenatal and postnatal classes.

Keep in mind, what's best is different from person to person. Be sure to look at many options and carefully read through the inclusions of each policy before making your decision.

To make sure you get accurate and helpful information, this guide has been edited by Tim Bennett as part of our fact-checking process.

Gary Ross Hunter was an editor at Finder, specialising in insurance. He’s been writing about life, travel, home, car, pet and health insurance for over 6 years and regularly appears as an insurance expert in publications including The Sydney Morning Herald, The Guardian and news.com.au. Gary holds a Kaplan Tier 2 General Advice General Insurance certification which meets the requirements of ASIC Regulatory Guide 146 (RG146). See full bio

Gary Ross's expertiseHealth insurance and tax

Ice, ice, baby: How much does egg freezing cost? Find out more about the costs of egg freezing and how to get cover.

Health insurance for gastroscopy Need health cover for gastroscopy? Find out how private health insurance and Medicare cover treatment and compare the costs for the most affordable option.

HBF health insurance review Winner of the 2024 Finder Insurance Award, HBF is a stand-out health insurer with some of the best value policies on the market.

GMHBA health insurance review GMHBA health insurance offers a wide range of hospital and extras policies, giving you tons of flexibility.

Health insurance with no waiting period It's not possible to skip waiting periods for health insurance but there are exceptions.

Health insurance for psychiatric care Mental health issues are serious and can be costly, which is why Australian health funds are legally obligated to offer cover for treatment.

How much does private health insurance cost? What does private health insurance typically cost? Our comprehensive guide will tell you.

Health insurance deals and offers for September 2024 Find out about the latest health insurance deals and special promotions.

HIF health insurance review As a not-for-profit brand, HIF is able to offer low premiums across both hospital and extras policies.

Australia

Level 10, 99 York St, Sydney NSW 2000

Finder acknowledges Aboriginal and Torres Strait Islanders as the traditional custodians of country throughout Australia and their continuing connection to land, waters and community.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market. Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them. Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options. Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money.

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.