Compare the best ways to send money from Iran to the United States. Explore the fastest, cheapest, and most reliable providers with the best IRR to USD exchange rates.

Read on for the best deals, expert information, and all you need to send money to the United States from Iran.

Transferring the other way? Send USD from United States to Iran instead.

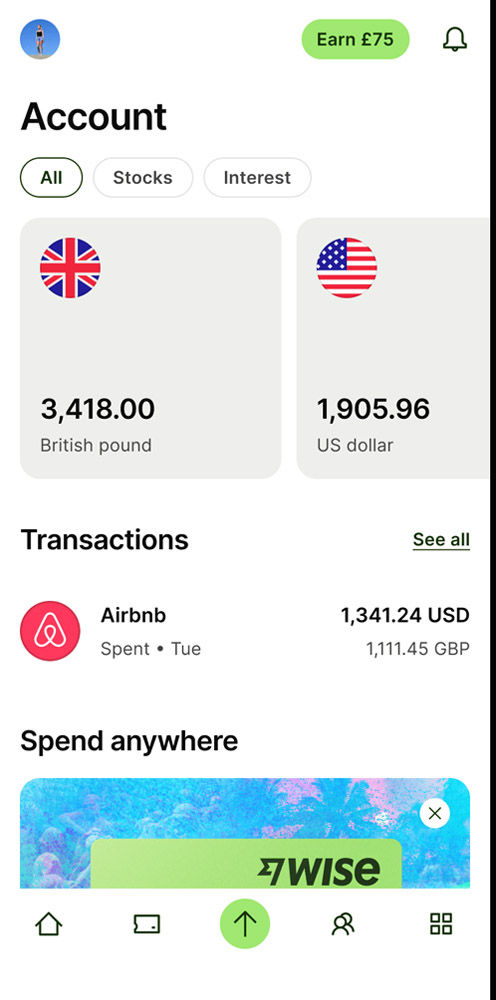

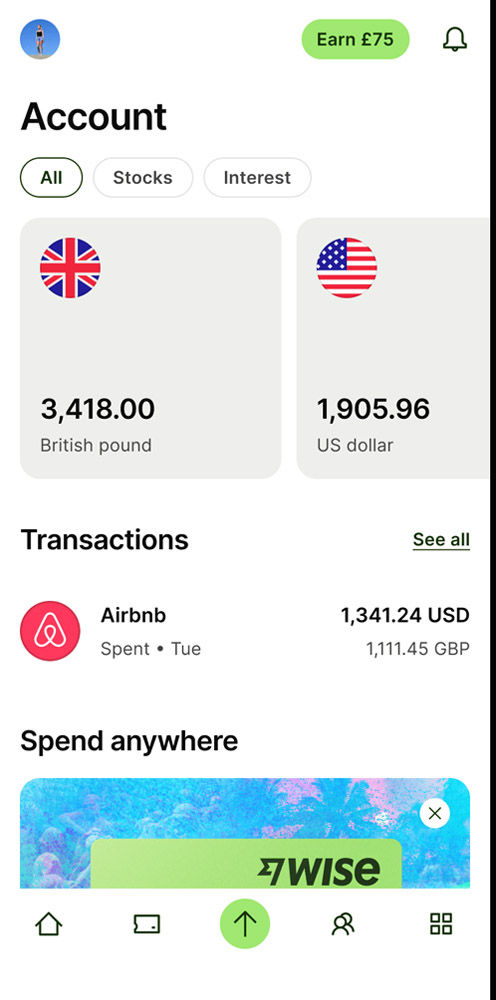

Comparison Best Cheapest FastestWe tested & reviewed dozens of money transfer providers, and Wise scored highly.

Wise appeared in 47.6% of Iran to the United States searches in the last 6 months, and was the top rated company out of 3 that support IRR to USD.

So for a great blend of cost, speed & features, make your Iran to the United States transfer using Wise.

Money transfers to United States should be easy. Use our live comparison tool to make sure you aren't missing the best rates to send money from Iran to the United States.

Search Live Rates Now![]()

![]()

![]()

Comparing providers offering services between Iran and the United States based on your specific transfer amount, is the easiest way to get the best price on your transfer.

We cover the entire IRR-USD market and have compared 3 providers offering services between Iran and the United States.

This ensures you will get the most comprehensive options for sending Iranian Rial to the United States.

Whilst we rate Wise as the best overall for transfers between the two countries, comparing gives you the best idea for your specific Iran to the United States transfer needs.

Beat the Iranian Rial-US Dollar exchange rateThe exchange rate determines the price you will pay when buying US Dollar in Iran. A better exchange rate means more Iranian Rials being sent to the United States.

The current rate between the Iranian Rial and US Dollar is 0.

The IRR-USD exchange rate is always changing. Understanding the average, and then waiting a day or two can help you get more USD for the same amount of Iranian Rials - but you might end up worse off.

A safer option if you want to get a particular rate is to use a forward contract. This allows you to lock in an agreed exchange rate between Iran and the United States.

Choose the right payment methodSending via a Bank transfer is the payment method that will get you the best price on a transfer from Iran to the United States.

Sokin is the company offering the best price currently on this.

Using Sokin for a Bank transfer to the United States from Iran is 0.7% cheaper than the next-best option in the market.

Financial regulations across Iran and United StatesIran and United States have different financial regulations to be aware of. Ensuring you fully understand these regulations will aid in keeping your money safe.

Our directory of worldwide financial regulators contains details on regulation for money transfers between Iran and United States.

Consider minimum and maximum limitsCompanies offering money transfers between Iran and the United States will have minimum or maximum thresholds on how much you can send or receive across set timeframes.

Exchange rates and fees for different transfer amounts could change and sending regularly could mean losing out.

That’s why it’s best to compare IRR-USD rates for your specific transfer amount.

For regular transfers to the United States to Iran, shopping around each time can make a huge difference.

For sending large amounts of IRR to United States without hitting a threshold, we’d recommended Wise. They offer a combination of rates and fees when sending from Iran to the United States that is the most competitive, even at larger amounts.

Be sure to check with the recipient and understand any declarations needed on large amounts of money entering the United States from Iran.

Receiving money in United StatesOptions for receiving US Dollar in the United States include direct bank deposit, cash pickup, a mobile wallet or receiving money into a multi-currency account.

Not all of the 3 providers offering transfers from Iran to the United States will support every method for incoming US Dollar, so it’s best to check ahead of time.

The most common option is to send directly from Iran to a bank account in the United States. For most part, this is convenient but does have receiving fees to potentially be aware of.

Wise is the best company for bank transfers between Iran and United States.

Cash pickup is popular in some parts of United States, but not always supported and can be costly compared to cheaper options.

Mobile wallet or P2P services and payment apps like PayPal, Xoom, and CashApp are popular because of convenience, but they come with more limitations and higher costs compared to money transfer providers like Payoneer.

Be ready with your IDWhen sending US Dollars to the United States, through a money transfer company, you will need to verify your ID when signing up.

The documents you need can vary and in some cases you might need a couple of options.

Generally, government issued ID such as a passport or driver's license are accepted in Iran. If the recipient needs an ID to collect money in the United States, the same applies there. You may also be able use other ID formats, where these aren’t available.

Large transactions between Iran and United States can be subject to additional checks such as proof of funds for anti-money laundering purposes. This may also require additional ID checks.

One of the reasons Wise as scored so highly for transfers to the United States is their easy sign up process in Iran.

Tax declarationsAs well as proof of funds, when sending large amounts of money between Iran and the United States there will be tax declarations to consider. This is also potentially due to regular transactions.

Some transfers into US Dollar may need to be reported to tax authorities in the United States and Iran, particularly where inheritance or property purchases are involved.

Tax limits and personal allowances do change in the United States based on age, income and a few other elements. Everyone’s tax obligations are unique - when in doubt, please contact a tax professional in Iran or the United States.

Comparing providers offering services between Iran and the United States based on your specific transfer amount, is the easiest way to get the best price on your transfer.

We cover the entire IRR-USD market and have compared 3 providers offering services between Iran and the United States.

This ensures you will get the most comprehensive options for sending Iranian Rial to the United States.

Whilst we rate Wise as the best overall for transfers between the two countries, comparing gives you the best idea for your specific Iran to the United States transfer needs.