Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

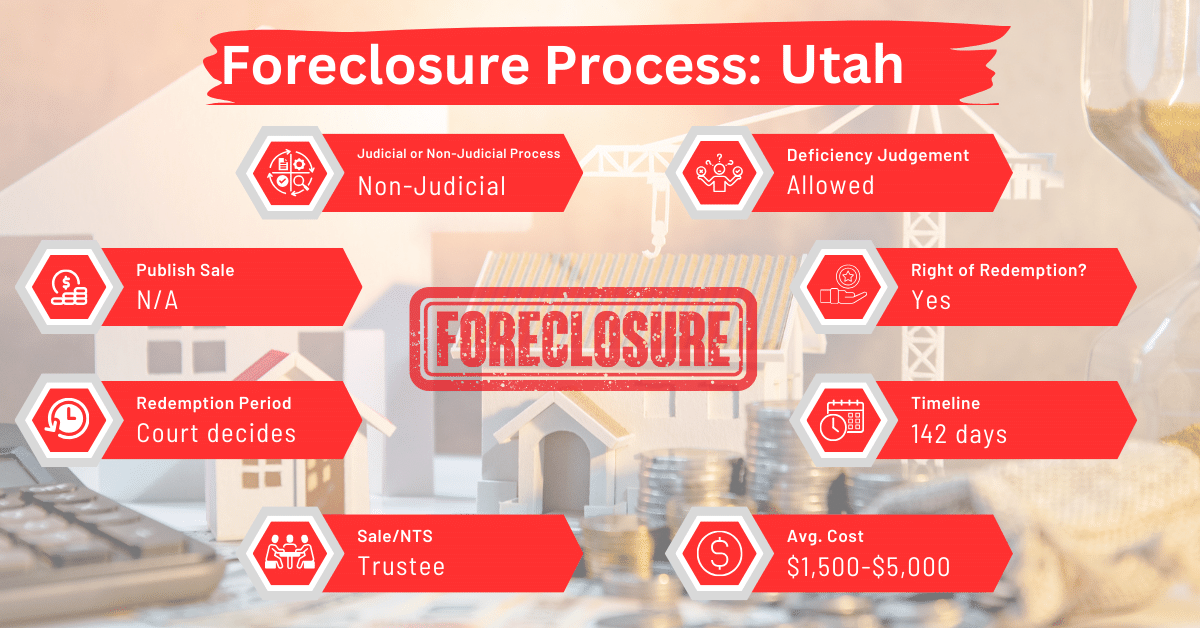

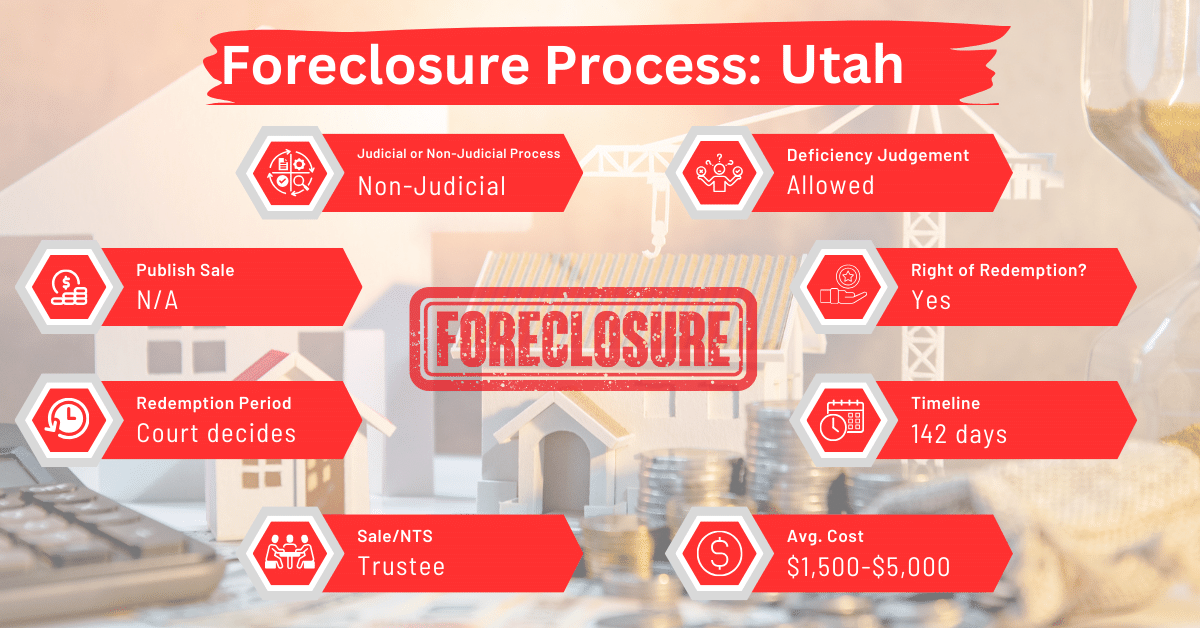

Foreclosure in Utah is known for its relative efficiency, with the entire process typically taking about five months. Both judicial and non-judicial foreclosures are possible in Utah, but non-judicial foreclosures are more common.

In Utah, foreclosures usually don’t go through the courts. However, they still take about 142 days, which is much slower than in many other states where foreclosures are primarily non-judicial, such as Georgia , Michigan , Mississippi , Missouri , Virginia , and Wyoming .

During the pre-foreclosure period in Utah, the lender initiates the foreclosure process by recording a notice of default with the county recorder and mailing a copy to the borrower. The borrower then has three months to rectify the default before the property is sold at public auction.

In Utah, foreclosures are usually done without going to court because it’s quicker and simpler. This process works when the mortgage has a special clause that lets the lender sell the property directly. But if this clause isn’t in the mortgage, then the foreclosure has to go through the court system.

This court-based method, known as judicial foreclosure, takes longer and is more complicated because it involves legal hearings and gives the borrower a chance to challenge the foreclosure. This court process is used to make sure everything is done legally when the mortgage doesn’t have the clause for a quicker foreclosure.

In Utah’s foreclosure process, after the notice of default is recorded, the sale notice is posted on the property at least 20 days preceding the sale. This makes sure people know about the upcoming sale. The notice is also published in a local newspaper weekly for three weeks and mailed to the borrower no less than 20 days before the sale date.

The actual sale is a public auction at the county courthouse, where anyone including the lender can bid. The highest bidder gets the property. What happens when the property is sold for an amount that’s greater than what’s left of the mortgage plus all foreclosure costs? The borrower is entitled to receive the difference between the sale price and all sums due under the mortgage (plus foreclosure costs).

An alternative to foreclosure in Utah is selling your mortgage note to a reputable note buyer. This option can provide immediate financial relief and avoid the lengthy and stressful foreclosure process.

The Utah Reverse Mortgage Act doesn’t give the borrower in a non-judicial foreclosure the right to post-sale redemption. This means the borrower cannot reclaim the property once the foreclosure sale is complete. Where the foreclosure is judicial, the court may determine the length of the post-sale redemption period.

Utah allows for deficiency judgments, where the borrower is liable for the difference between the sale price and the mortgage balance.

Utah does not offer specific state-level foreclosure protections or programs beyond the standard judicial and non-judicial processes. Borrowers may need to seek external assistance or legal counsel to navigate the foreclosure process.

We examine Utah’s foreclosure methods in relation to other states, specifically looking at differences in notice periods, associated costs, and how they affect credit scores.

In Utah, the foreclosure process includes a requirement to publish a sale notice at least 20 days before the auction. This duration is shorter compared to many other states, including: Alabama , Alaska , Arizona , California , Colorado , Hawaii , Idaho, Massachusetts , Montana , Nevada , New Hampshire , North Carolina , Oregon , Rhode Island , Washington , and West Virginia .

Foreclosure costs in Utah, which encompass legal fees, publication costs, and other related expenses, range between $1,500 and $5,000. These costs can vary depending on the complexity of the foreclosure process but are typically within a range that is consistent with what is observed in other states.

A foreclosure typically leads to a significant decrease in the homeowner’s credit score, often by 100 points or more. This negative impact, common across all states including Utah, remains on the credit report for seven years but becomes less impactful over time with responsible credit management.

Before carrying out foreclosure in Utah, you must understand its judicial and non-judicial processes and the rights and protections afforded to borrowers. Selling a mortgage note can be a viable alternative to avoid foreclosure. Being aware of these details can help homeowners and investors effectively manage or invest in properties within the foreclosure landscape in Utah.