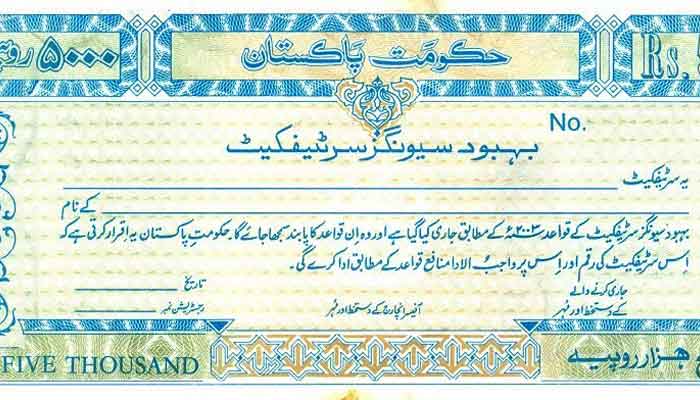

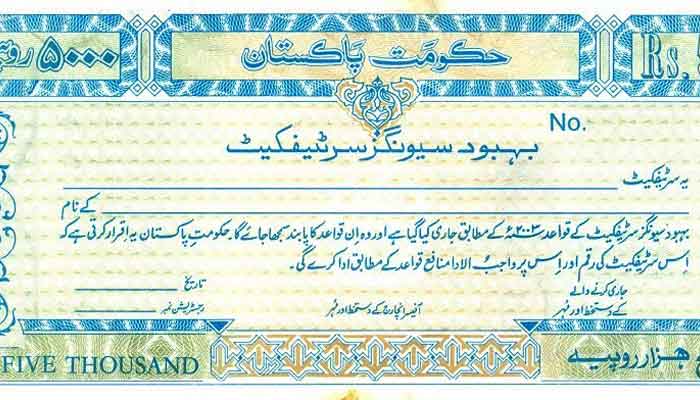

Keeping in view the hardships faced by the widows and senior citizens, Behbood Savings Certificates (BSCs) with a 10-years maturity period were launched by the Government of Pakistan on July 30, 2003. Initially, BSC was meant for widows only; however, it was decided later by the Government to extend the facility to senior citizen aged 60 years and above with effect from January 1, 2004. It has now further been extended to Disables holding NIC with Disability logo or Special Minors through Guardians with effect from April 23, 2018.

BSC is available in the denominations of:

Payments can be made the holders jointly or to either with the written consent of the other (Joint class-A) and to either (Joint class-B).

How to Purchase?

BSC can be purchased only from the National Savings Centers (NSC) by filling in SC-1 (Application Form), available free of cost from the issuing offices.

Documents Required with the Application Form

To download application form click here

Mode of Deposit

BSCs can be purchased by depositing cash at the issuing office or by presenting a cheque/ draft/ pay-order. In case of deposit through cheque/ draft/ pay-order, the Certificates will be issued with effect from the date of realization of the cheque/ draft/ pay-order after receipt of the clearance advice. However, the Certificates shall be issued immediately against the cash payment.

Investment Limit

For a single investor: Rs. 5 million

For Joint investor (Category (a) or (b)): Rs.10 million

BSCs can be enchased any time after issuance subject to the deduction of service charges at the following rates:

Furthermore, the Certificates issued/purchased/ reinvested on or after 15-11-2010 shall not be reinvested on maturity.

Rate of Return/Profit rates

For details click here

Tax & Zakat Status

Withholding tax is not collected on the profit earned on BSCs. Investments made in the BSC are also exempted from Zakat collection.